Abhijith Preman, FCA

Helping growth-stage startups and SMEs build financial discipline, achieve investment readiness, and secure funding—driving profitability and structured growth with strategic fund deployment.

About Me

Abhijith Preman is a Fellow Chartered Accountant (FCA) with over 13 years of extensive experience in finance, investment advisory, and startup consulting. He has played a pivotal role in fundraising, mergers & acquisitions (M&A), financial due diligence, and business valuations, providing strategic financial insights to startups, investors, and corporations across India, the United States, and the United Arab Emirates.

As a Partner at Abhijith Preman & Co. LLP Chartered Accountants, he leads a team of finance professionals specialising in business structuring, compliance, tax advisory, and financial management. The firm provides end-to-end financial solutions for growth stage startups and established businesses, ensuring robust financial planning, regulatory compliance, and strategic growth advisory. His leadership in the firm underscores his commitment to helping businesses scale efficiently while maintaining financial discipline and compliance integrity.

With a track record of 40+ due diligence engagements, 50+ fundraising transactions, and 5 M&A deals, Abhijith has worked alongside leading investors, venture capital firms, and industry giants, including Amazon and InfoEdge. He has successfully structured and facilitated capital-raising initiatives exceeding USD 60 million, ensuring optimal financial and legal outcomes for his clients.

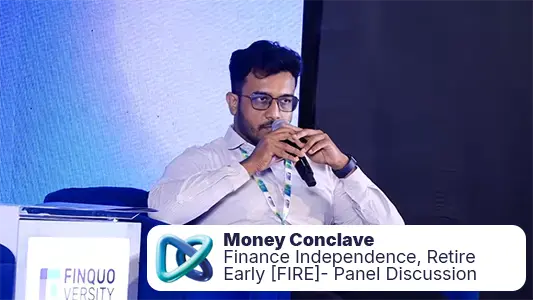

A dedicated advocate for financial literacy and investment readiness, Abhijith frequently shares his expertise through public speaking, podcasts, financial publications, and mentorship programs. As a Founding Member at Money Conclave, a Global Wealth Summit, and a national-level speaker at ICAI events, he has guided numerous entrepreneurs on fundraising strategies, compliance, and business financial management.

Key Areas of Expertise

A. Fundraising & Investment Advisory

- Structured and facilitated 50+ fundraising deals, securing over USD 60 million in investments.

- Advised startups on investor readiness, term sheets, equity structuring, and financial modelling.

- Worked closely with angel investors, venture capitalists, and institutional funds to drive successful capital raises.

B. Mergers & Acquisitions (M&A) Transactions

- Played a key role in 5 M&A transactions, managing financial assessments, negotiations, and deal execution.

- Ensured smooth transitions and strategic alignments for acquisitions involving Amazon, InfoEdge, and other global investors.

C. Due Diligence & Business Valuation

- Conducted 40+ due diligence assessments for investors, funds, and corporate acquisitions.

- Expertise in financial risk analysis, investment viability assessment, and forensic financial reviews.

- Prepared comprehensive business valuation reports to support investment and M&A decisions.

D. Global Financial Consulting & Cross-Border Transactions

- Provided financial and compliance advisory to startups expanding across India, the US, and the UAE.

- Navigated cross-border investment structures, tax implications, and regulatory compliance frameworks.

E. Leadership, Startup Mentorship & Public Speaking

- Founding Member at Money Conclave, a Global Wealth Summit.

- Advising early-stage startups on financial structuring and fundraising as a part of different programmes organized by Kerala Startup Mission [KSUM].

- National-level speaker at ICAI events, covering startup finance, business structuring, and investment strategies.

- Frequent guest speaker on podcasts, startup events, and financial literacy programs.

Gallery